BLOG

”It worked out just like Eddie said! I bought a note from a private owner. It paid off early and I did it all with my Roth IRA”

– Bob Bullinger

30September

September 2021 Market Update

GUEST: BOB REPASS Bob Repass is a 25-year veteran and expert in the seller finance mortgage and distressed asset industry. Over the course of his career, he has purchased over 40,000 performing and non-performing mortgage loans totaling over $2 billion dollars in volume, giving him an unparalleled track record in the industry. Bob currently serves as Managing Director of Colonial Funding Group, where he shares overall responsibility for the management

Read More

Categories : Education

16September

Building Legacy Wealth

GUEST: GARY NIE Gary Nie and his wife are both veterinarians, and own their own clinic in Springfield, Missouri. (Believe it or not, he actually does acupuncture on horses.) They’ve been running their own business for 16 years. Even though he owns his own company, he realized he has been trading time for money just like an employee. He only makes money when he’s at the clinic seeing patients. So

Read More

Categories : Education

GUEST: RYAN + JENNY PENNOCK Ryan and Jenny Pennock came to the real estate industry after closing down their indoor gun range in 2018. That was a low point, but they dove into the real estate business. Ryan did fix & flips, and Jenny became a real estate agent for Keller Williams. They’ve been landlords, wholesalers, and rehabbers, and experienced the headaches that come with those facets of the business.

Read More

Categories : Education

02September

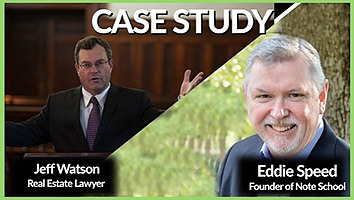

The Legal Side of Notes

GUEST: JEFF WATSON Jeff Watson is a powerhouse attorney specializing in the laws and regulations affecting the note business. (He also happens to be Eddie’s personal attorney!) Jeff is one of the most highly sought-after attorneys in the country when it comes to Self-Directed IRA Investing. Jeff spends much of his time teaching & attending events and representing real estate investors in Washington D.C. In today’s NoteSchool TV episode, Jeff

Read More

Categories : Education

EDDIE SPEED + JOE VARNADORE Eddie Speed is a driving force in the creative financing and non-performing note industry. He has introduced innovative ideas and strategies that have positively impacted the way the industry operates today. He founded NoteSchool 20 years ago (after being in the note industry for 20 years), where he and his team teach thousands of students how to architect deals with terms in their favor. He’s

Read More

Categories : Education

CATEGORIES

Live Training Events

Advanced Classes